#Defining Forex Trading Signals

Explore tagged Tumblr posts

Text

This blog serves as a user-friendly guide for those just stepping into the world of forex trading. It meticulously breaks down the concept of forex trading signals, highlighting their immense value for beginners in navigating the intricate forex market. It emphasizes the advantages of using signals, such as their potential to save time, reduce emotional stress, and offer a learning opportunity for novice traders. Throughout the guide, the presence of Funded Traders Global as a supportive and educational partner is evident, ensuring that beginners gain confidence in their learn more...

#Analyzing Fundamental Data#Basics of Trading Signals#Candlestick patterns#Complete Guide to Forex Trading Signals for Beginners#currency pairs#Defining Forex Trading Signals#dojis#economic calendars#economic indicators#engulfing candles#Evaluating Sentiment Indicators#Forex charts#Forex News Sources#forex trading 2023#Forex Trading Signals for Beginners#Fundamental Analysis Signals#hammers#How to Choose a Reliable Provider#How to Find Forex Trading Signals#Interpreting Forex Trading Signals#MACD (Moving Average Convergence Divergence)#Market Analysis Tools#Market Sentiment Indicators#mood and perceptions of traders in the market#moving averages#Position Sizing Strategies#Risk Management in Forex Trading#RSI (Relative Strength Index)#Self-Analysis and Research#Sentiment Analysis Signals

0 notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

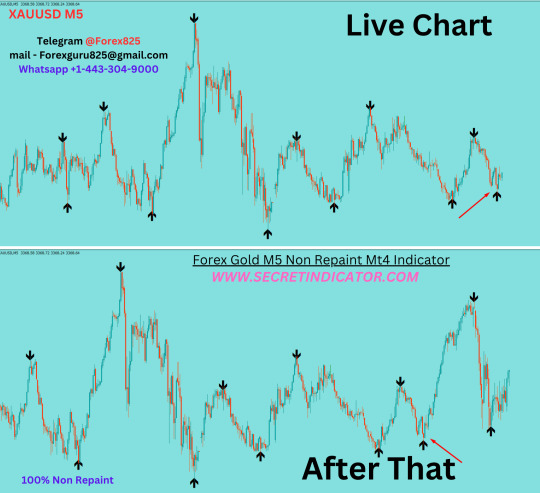

good indicators for forex trading

📊 Good Indicators for Forex Trading: The Ultimate Guide for Profitable Trades

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

✅ Introduction

Forex trading is both an art and a science. While price action and market psychology play key roles, technical indicators help traders make objective, data-driven decisions. Whether you’re a beginner or an experienced trader, choosing the right indicators can dramatically improve your entries, exits, risk management, and profitability.

But with hundreds of forex indicators available — from the classic moving averages to exotic custom tools — how do you know which ones truly work?

This detailed article explores:

What forex indicators do

The core types of indicators

The best and most commonly used indicators

How to use them effectively in combination

Common mistakes and tips for better results

📌 Table of Contents

What Are Forex Indicators?

Types of Technical Indicators

Why Indicators Matter in Forex Trading

The Top 10 Good Indicators for Forex

Deep Dive into the Most Effective Indicators

Best Indicator Combinations

Tips for Using Indicators Effectively

Common Mistakes to Avoid

How to Backtest and Optimize Indicators

Final Thoughts

1. 📉 What Are Forex Indicators?

Forex indicators are mathematical calculations based on price, volume, or open interest. They analyze past market data to help traders make predictions about future price movements. Indicators are typically plotted on or below a chart and can signal:

Trend direction

Reversal zones

Entry/exit points

Market strength

Volatility

Overbought/oversold levels

They don't predict the future perfectly, but when used correctly, they help you make probability-based decisions.

2. 📊 Types of Technical Indicators

Forex indicators fall into several major categories:

🔹 Trend Indicators

Identify the direction and strength of market trends.

Examples: Moving Averages, MACD, ADX, Ichimoku Cloud

🔹 Momentum Indicators

Measure the speed of price movement to find overbought/oversold areas.

Examples: RSI, Stochastic Oscillator, CCI

🔹 Volatility Indicators

Measure the rate of price fluctuations, showing when the market is quiet or explosive.

Examples: Bollinger Bands, ATR (Average True Range)

🔹 Volume Indicators

Gauge trading volume, often used to confirm the validity of price moves.

Examples: OBV, Volume Oscillator, Chaikin Money Flow

🔹 Custom or Composite Indicators

Combine multiple tools or custom formulas.

Examples: TDI (Traders Dynamic Index), Supertrend, Pivot Point Indicator

Each type has a purpose. Great trading strategies usually combine 2–3 different types.

3. 🧠 Why Indicators Matter in Forex Trading

Trading without indicators is like driving without a speedometer or GPS — possible, but risky and uncertain.

Good indicators help:

Define trading rules

Add objectivity to decision-making

Reduce emotional trading

Confirm entries and exits

Prevent overtrading in choppy markets

Identify trends early or avoid weak ones

They don’t guarantee success — but they increase your statistical edge.

4. ✅ The Top 10 Good Indicators for Forex Trading

Here are ten indicators that are time-tested, effective, and widely used by traders across all levels: RankIndicatorTypeUse Case1Moving Averages (EMA/SMA)TrendIdentify direction and smooth price2Relative Strength Index (RSI)MomentumSpot overbought/oversold areas3MACDTrend/MomentumSignal trend changes via crossovers4Bollinger BandsVolatilityBreakout signals, range bounds5ADXTrend StrengthMeasure trend strength (not direction)6Stochastic OscillatorMomentumShort-term reversal entries7ATRVolatilitySet dynamic stop-loss based on volatility8Ichimoku CloudTrendComplete trend system with signals9Fibonacci RetracementSupport/ResistanceIdentify pullback and entry zones10Volume Indicators (OBV/CMF)VolumeConfirm trends and breakouts

Let’s now explore some of the best ones in detail.

5. 🔍 Deep Dive: Best Indicators Explained

🔹 1. Moving Averages (EMA & SMA)

Simple Moving Average (SMA): averages price over a period.

Exponential Moving Average (EMA): gives more weight to recent prices.

Popular Uses:

50 EMA & 200 EMA crossovers = trend change

Price above 200 EMA = long bias, below = short bias

Use slope of EMA for trend strength

Pro Tip: Use moving average channels for dynamic support/resistance.

🔹 2. Relative Strength Index (RSI)

Ranges from 0 to 100

Above 70 = Overbought (possible sell)

Below 30 = Oversold (possible buy)

How to Use:

Divergence between RSI and price = strong reversal signal

Combine with support/resistance zones

Use RSI > 50 in uptrends, < 50 in downtrends

🔹 3. MACD (Moving Average Convergence Divergence)

Consists of:

MACD line (12 EMA – 26 EMA)

Signal line (9 EMA of MACD)

Histogram (difference between MACD and signal)

Strategy:

MACD line crossing above signal = buy signal

Use MACD divergence to detect early trend reversals

🔹 4. Bollinger Bands

3 lines: Upper, Middle (SMA), Lower band

Bands widen with volatility, contract in calm markets

Trading Ideas:

Price touches lower band + oversold RSI = potential long

Breakout with volume = trend beginning

Range-bound strategy: buy at lower band, sell at upper

🔹 5. ADX (Average Directional Index)

Measures trend strength, not direction

Value > 25 = trend is gaining momentum

Value < 20 = market is ranging

Combine with:

+DI and –DI lines to see bull vs bear strength

Trendline or MA to confirm direction

🔹 6. Stochastic Oscillator

Two lines: %K and %D

Values > 80 = overbought, < 20 = oversold

How to Trade:

Buy when %K crosses above %D in oversold zone

Sell when %K crosses below %D in overbought zone

Best in ranging or corrective phases

🔹 7. ATR (Average True Range)

Measures volatility, not direction

Use for:

Setting realistic stop-losses based on market behavior

Filtering out low-volatility trades

Adjusting position sizing dynamically

🔹 8. Ichimoku Cloud

A complete system: trend, momentum, and future resistance zones

Components:

Kumo Cloud: dynamic S/R

Tenkan & Kijun: short-term trend crossovers

Chikou Span: lagging confirmation

Works best on H4 and D1 timeframes.

🔹 9. Fibonacci Retracement

Tool based on key price ratios (0.382, 0.5, 0.618)

Great for pullback entries in trends

Strategy:

Price retraces to 61.8% + MA support = strong long setup

Combine with candle signals or trendline breaks

🔹 10. Volume Indicators

OBV (On-Balance Volume): volume flow

Chaikin Money Flow: volume + price pressure

Use them to:

Confirm breakouts

Spot early accumulation/distribution

Add strength to RSI/MACD setups

6. 🔗 Best Indicator Combinations

No single indicator is perfect. Here are some powerful combos:

✅ RSI + Bollinger Bands

RSI confirms overbought/oversold

BB shows volatility edge

✅ ADX + Moving Averages

MA shows direction, ADX confirms trend strength

✅ MACD + Volume

MACD gives direction change

Volume confirms if it’s real

✅ Stochastic + Fibonacci

Stochastic entry after Fib retracement level

Always look for confluence of signals before entering a trade.

7. 🧠 Tips for Using Indicators Effectively

Use indicators to confirm, not control decisions

Stick to 2–3 indicators max — don’t clutter your chart

Adjust indicator settings based on timeframe and strategy

Use support/resistance and candlestick patterns as base context

Watch for divergence for early reversal warnings

8. ❌ Common Mistakes to Avoid

Over-reliance on indicators

Using too many conflicting tools

Not backtesting indicators

Ignoring market context

Trading all signals — not all are valid

Remember: Indicators follow price, not the other way around. Context is king.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex factory#forex market#forex education#forex online trading#forex broker#crypto#forex news#forex#forex indicators#forex ea

0 notes

Text

10 Forex Market Moves to Watch Amid Trade War Risks

Market Analysis

GOLD

Among the 10 Forex Market Moves, GOLD is in focus as it consolidates near the EMA200 and the lower boundary of a defined range. Momentum indicators, including MACD and RSI, signal neutrality, with no clear breakout yet. However, recent comments by President Trump threatening 50% tariffs on imported metals have historically triggered safe-haven demand. While a short-lived surge followed, we remain on standby for a clearer directional push, as broader sentiment toward the U.S. economy and trade policy will drive gold’s next move. For expert insights on gold positioning, visit RichSmart FX.

SILVER

SILVER is also part of the 10 Forex Market Moves, exhibiting a similar consolidation pattern. Though prices are steady under recent highs, increased pressure toward the upper end of the range suggests potential for a breakout. We will await stronger confirmation before calling direction. For silver trading updates, check RichSmart.net.

DXY

The U.S. Dollar Index enters the 10 Forex Market Moves lineup with sideways price action leaning slightly bearish. This is partly due to trade-related uncertainty. MACD and RSI indicate sufficient volume for a continued move lower, and further selling is anticipated if trade tensions deepen. Broader currency context is available at Axel Private Market.

GBPUSD

As one of the more dynamic currencies in the 10 Forex Market Moves, the Pound is supported by the EMA200. RSI shows bullish momentum but is nearing overbought levels. The MACD confirms an upward trend with strong volume. If GBP/USD can push past the 1.34998 resistance cleanly, we expect additional gains in alignment with the current bullish structure. For real-time analysis, visit GFS Markets.

AUDUSD

The Australian Dollar is rallying after support at the 0.64086 level, positioning itself firmly within the 10 Forex Market Moves. Bullish volume is supported by strong MACD and RSI momentum. With price action respecting the uptrend, we continue to look for buying opportunities unless a structural break occurs. Learn more from DBGMFX.

NZDUSD

NZD/USD has bounced from structural support and enters the 10 Forex Market Moves thanks to rising bullish volume on the MACD. RSI is nearing overbought conditions, but overall sentiment remains constructive. We are watching for a potential continuation higher, with price structure remaining supportive. Review the Kiwi's trade setups on TopMax Global.

EURUSD

EUR/USD is testing the upper edge of its consolidation zone. As part of the 10 Forex Market Moves, this pair is at a pivotal level. MACD shows rising bullish potential while RSI signals caution due to overbought pressure. Until a breakout occurs, we will observe for signs of momentum validation. For further trend analysis, check WorldQuest FX.

USDJPY

USD/JPY remains rangebound near the EMA200, fitting well into the 10 Forex Market Moves due to its uncertain directional cues. MACD and RSI indicate bearish momentum, but a longer-term bullish bias is maintained. A break above 143.442 or below the EMA200 will confirm the next leg.

USDCHF

USD/CHF is showing bearish consolidation just under a critical resistance zone. It joins the 10 Forex Market Moves for its potential to break lower, following increased Franc strength. MACD and RSI remain steady in bearish territory, though confirmation is still needed before calling continuation.

USDCAD

USD/CAD completes the 10 Forex Market Moves with a continued bearish bias. Recent Canadian GDP data and steady BoC policy reinforce Loonie strength. The pair is testing the 1.36612 level, and MACD/RSI both confirm bearish pressure. We expect more selling unless a structural reversal emerges.

COT Market Analysis

AUD - WEAK (5/5)

GBP - STRONG (5/5)

CAD - WEAK (5/5)

EUR - STRONG (3/5)

JPY - STRONG (3/5)

CHF - WEAK (4/5)

USD - MIXED

NZD - WEAK (4/5)

GOLD - STRONG (3/5)

SILVER - STRONG (5/5)

Final Thoughts

The 10 Forex Market Moves this week reflect a market at the crossroads of technical consolidation and fundamental uncertainty. With major assets like GOLD, DXY, and EUR/USD sitting at key structural levels, the next major shift may be sparked by trade war developments or macroeconomic surprises.

0 notes

Text

Trade Smarter in Dubai: Discover the Best Online Forex Platform

Introduction: The Rise of Online Forex Trading in Dubai

Over the past decade, Dubai has emerged as a global hub for smart investing. Among the most popular investment options is online forex trading in Dubai — a rapidly growing field that offers high liquidity, flexible trading hours, and numerous profit opportunities. With a well-regulated financial environment and tech-savvy investors, Dubai presents the ideal location to engage in forex markets.

To trade successfully, investors must select the best trading platforms in UAE, tailored to offer real-time analytics, secure access, and compliant trading tools. Whether you’re a seasoned trader or just getting started, having access to the best CFD trading apps UAE can significantly impact your performance and confidence.

Why Choose Forex Trading in Dubai?

Forex trading Dubai has become increasingly attractive due to its strategic location, financial regulations, and access to a wide array of global currencies. Dubai offers both resident and international investors a stable economic environment and easy access to Middle Eastern, Asian, and European markets.

Moreover, the availability of a licensed trading account Dubai ensures that investors operate under regulated conditions. This helps in building trust, maintaining compliance, and minimizing risks, especially for new traders entering the market.

Key Features of the Best Trading Platforms in UAE

When selecting from the best trading platforms in UAE, there are several core features to consider:

User-Friendly Interface: An intuitive layout is essential for executing fast trades without confusion.

Real-Time Market Data: Access to live price feeds and analysis tools helps traders make informed decisions.

Advanced Charting Tools: Platforms offering custom indicators and technical analysis support give traders a competitive edge.

Security & Regulation: Trading with a licensed trading account Dubai ensures investor funds are protected and the platform complies with regional regulations.

Multi-Asset Support: The best platforms also provide access to CFDs, allowing for a more diversified portfolio via the best CFD trading apps UAE.

These features collectively define what makes a platform reliable for online forex trading in Dubai.

Benefits of Using the Best CFD Trading Apps UAE

The growing popularity of Contracts for Difference (CFDs) in the UAE has led to the emergence of mobile-friendly platforms that offer seamless trading on the go. The best CFD trading apps UAE provide:

Flexible Leverage: Traders can amplify their positions without committing large capital.

Short-Selling Opportunities: Profit even in falling markets.

Diverse Instruments: Access forex, indices, commodities, and more from a single app.

Real-Time Alerts: Get notified instantly about price movements or trade signals.

How to Open a Licensed Trading Account in Dubai

Opening a licensed trading account Dubai is the first step toward professional-level trading. Here’s how you can get started:

Choose a Regulated Broker: Ensure the broker is licensed by a recognized authority such as the UAE’s Securities and Commodities Authority (SCA).

Complete KYC Requirements: Submit valid identification documents, proof of address, and income details.

Verify Your Account: Once documents are approved, you’ll receive verification and access to your trading account.

Fund Your Account: Use secure payment methods to deposit funds.

Start Trading: Utilize the features of the best trading platforms in UAE begin trading forex and CFDs

This structured process ensures you are fully compliant and protected while engaging in online forex trading in Dubai.

Comparing the Best Trading Platforms in UAE

When comparing platforms, it’s essential to focus on what suits your trading style. Some platforms excel in technical tools, while others prioritize beginner-friendly features. Here are some elements to compare:

Speed and Performance: Look for platforms with minimal downtime and fast order execution.

Educational Content: Platforms that offer webinars, tutorials, and market updates help you grow as a trader.

Demo Accounts: Practice risk-free before investing real money.

Customer Support: 24/7 multilingual support is a major advantage for both novice and advanced traders.

Combining these factors allows you to identify the best trading platforms in UAE that match your investment goals and experience level.

Online Forex Trading in Dubai: Key Regulations and Compliance

The UAE has implemented strict regulations to ensure that online forex trading in Dubai is conducted ethically and securely. Traders must use platforms that are:

SCA-Licensed: Ensures transparency and investor protection.

Anti-Money Laundering Compliant: Monitors for fraudulent activities and high-risk behaviors.

Segregated Accounts: Protects clients’ funds from being misused.

These regulations are a strong reason why forex trading Dubai is trusted by both local and international investors. It creates a secure environment where performance and strategy — not fear — drive success.

Why Mobile Trading is Changing the Game

With smartphones now more powerful than ever, mobile apps are transforming how traders engage with the market. The best CFD trading apps UAE allow users to:

Monitor global markets 24/7

Execute trades with one tap

Access performance analytics

Sync with desktop platforms

This has brought unmatched flexibility to online forex trading in Dubai, especially for traders who want to react instantly to market shifts. In a fast-moving market, being mobile gives you the edge.

Conclusion: Choosing the Right Forex Platform in Dubai

To trade smarter in Dubai, choosing the right platform is critical. The landscape of forex trading Dubai is both exciting and competitive, and success depends heavily on the tools you use.

By selecting from the best trading platforms in UAE, using the best CFD trading apps UAE, and ensuring you operate through a licensed trading account Dubai, you can trade with confidence, compliance, and clarity.

Online forex trading in Dubai is no longer just a trend — it’s a strategic opportunity. With the right platform, smart choices, and a solid understanding of market dynamics, you can navigate the forex world efficiently and profitably.

#Best CFD trading apps UAE#Forex trading Dubai#Best trading platforms in UAE#Online forex trading in Dubai#Licensed trading account Dubai

0 notes

Text

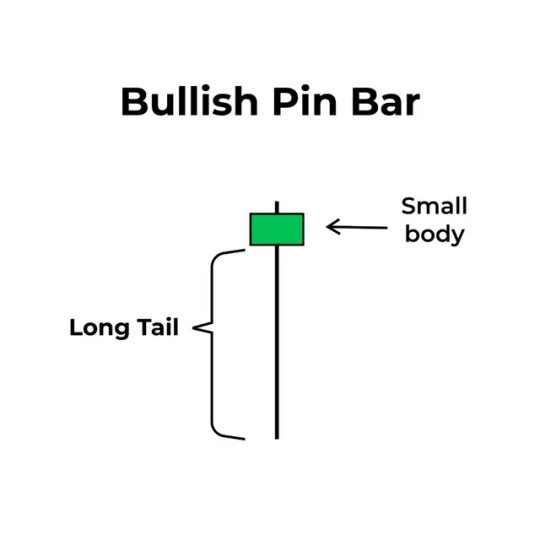

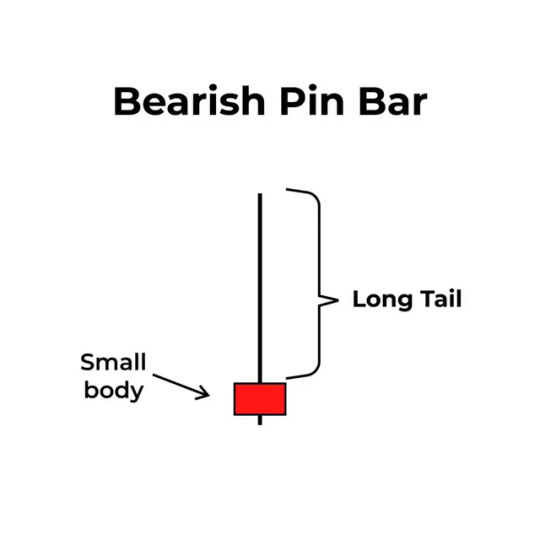

Pin Bar Candlestick Pattern: A Trader’s Guide to Smart Entries and Exits

Have you ever noticed a candle on a chart that looks like a pin or a needle? That structure is known as a pin bar, and it can give traders powerful insights into future price movement. Whether you're entering or exiting a trade, the pin bar can help you make smarter, more strategic decisions.

If you've found it challenging to recognize or understand this pattern, you're not alone. In this Market Investopedia guide, we’ll walk you through everything you need to know about pin bars—how they work, their pros and cons, and how to trade them effectively.

What Is a Pin Bar?

A pin bar is a candlestick formation that signals a potential price reversal or continuation. It’s made up of:

A small body (green or red),

A long wick on one end,

And a short wick on the opposite end.

This structure reveals price rejection—meaning the market attempted to move in one direction but was strongly pushed back, hinting at an upcoming shift.

Key Features of a Pin Bar

To identify a pin bar, look for the following elements on your chart:

Small Candle Body

The body should be short, showing little difference between the opening and closing prices. This indicates a balance—or struggle—between buyers and sellers.

Wicks (Shadows)

There are two wicks on a pin bar. One is very long, and the other is short. The long wick reveals where the price was rejected, and it's the most important part of the pin bar.

Closed Candle

Never trade a pin bar that hasn’t closed yet. Wait for the candle to close before making a decision based on its signal.

Types of Pin Bars

Bullish Pin Bar

Appears during a downtrend

Has a small green body

Features a long lower wick

Signals a potential upward reversal

The long lower wick suggests sellers pushed the price down, but buyers fought back, rejecting the lower levels. This often indicates a buying opportunity.

Bearish Pin Bar

Appears during an uptrend

Has a small red body

Features a long upper wick

Signals a potential downward reversal

Here, buyers tried to push the price higher, but sellers stepped in and rejected the highs. This often signals a selling opportunity.

How to Trade Using Pin Bars

1. Identify a Pin Bar

Scan your chart (preferably 4-hour, daily, or weekly) for a small-bodied candle with a long wick on one end and a short wick on the other.

2. Use Confirmation Tools

Combine pin bars with tools like:

RSI (Relative Strength Index)

Fibonacci Retracement

Bollinger Bands These indicators can help confirm whether the signal is strong enough to act on.

3. Trade Reversals

When a pin bar forms at a key support or resistance level, it often signals a reversal. Trade in the direction opposite the long wick.

4. Trade Trend Continuations

Not every pin bar signals a reversal. In some cases, especially during a trend pause, a pin bar can indicate that the current trend is about to continue. For example, a bullish pin bar during an uptrend suggests that buyers are still in control.

How to Spot High-Quality Pin Bars

Not all pin bars are equal. Here's what to look for in a strong setup:

Key Levels: Look for pin bars forming at significant support or resistance zones.

Longer Time Frames: Pin bars on 4H, daily, or weekly charts tend to be more reliable than those on 5-minute or 15-minute charts.

Wick Length: The longer the wick (at least two-thirds of the candle's length), the stronger the signal.

Smaller Body: A smaller body means less indecision and more rejection.

Volume Confirmation: Higher trading volume strengthens the validity of the pattern.

Pros of Trading Pin Bars

Easy to recognize, even for beginners

Work well with various assets—Forex, stocks, crypto, commodities Clearly define potential entry and exit levels

Combine well with trendlines, moving averages, and other tools Suitable for multiple timeframes

Cons of Trading Pin Bars

Less effective in choppy or sideways markets

Relies on probabilities—there’s no guarantee the signal will play out

Can produce false signals without proper confirmation

Final Thoughts

The pin bar candlestick is a powerful yet simple tool that traders can use to spot trend reversals or continuations. It's easy to learn, and when combined with other forms of analysis, it can provide high-probability trade setups.

However, like any trading method, pin bars are not foolproof. It's important to assess each one carefully, confirm the signal, and avoid trading them in low-quality setups or during erratic market conditions.

Ready to dive deeper into price action and trading strategies? Explore more articles on Market Investopedia or join our free webinar for hands-on learning with real chart examples.

0 notes

Text

Smart Strategies for Success in Forex Trading

To succeed in forex trading, it's essential to follow expert advice, prioritize risk management, and maintain discipline. Create a clear trading plan with defined entry, exit, and risk rules, and avoid over-leveraging or risking more than you can afford. Stay informed on economic news, central bank actions, and global events that influence the market. Use trusted forex signal provider to support your analysis, and continually educate yourself to adapt to changing market conditions for long-term success.

0 notes

Link

#ActiveInvesting#CandlestickAnalysis#chartpatterns#MarketMovements#marketvolatility#priceaction#ProfitTaking#riskmanagement#Short-TermTrading#StockMarket#SwingTrading#technicalanalysis#TradingSignals#TradingStrategy#TrendFollowing

0 notes

Text

Fortune Maker Engine Review 2025: Is It Legit Or A Scam?

⭐ Overall Rating: 4.4/5 ⭐⭐⭐⭐☆

Performance: ⭐⭐⭐⭐⭐ (4.6/5)

Ease of Use: ⭐⭐⭐⭐☆ (4.3/5)

AI Capabilities: ⭐⭐⭐⭐☆ (4.4/5)

Customer Support: ⭐⭐⭐⭐☆ (4.2/5)

Security: ⭐⭐⭐⭐☆ (4.5/5)

👉 Open Your Fortune Maker Engine Account Now

🔍 Introduction

In 2025, AI-powered financial tools have flooded the market—but few generate the buzz of Fortune Maker Engine. Designed to simplify trading and investment strategy, this platform claims to turn even beginners into data-savvy investors through its automation and smart analytics.

But does it actually deliver, or is it another overhyped product? This comprehensive review breaks it down from features to real user feedback, and everything in between.

💡 What is Fortune Maker Engine?

Fortune Maker Engine is an intelligent trading automation platform that uses advanced AI algorithms to monitor markets, generate signals, and execute trades. Whether you're new to investing or a seasoned trader, it claims to optimize financial decisions with precision.

It supports multiple asset classes—cryptocurrency, stocks, forex—and works with several regulated brokerages worldwide.

🔑 Key Features of Fortune Maker Engine

✔ Real-Time Market Analysis – Tracks trends and anomalies across various markets using AI. ✔ Auto-Trading Functionality – Executes trades based on pre-set risk parameters. ✔ Customizable Dashboards – Tailor your analytics view based on asset class or strategy. ✔ Smart Portfolio Balancing – Automatically rebalances to match investor goals. ✔ Integrated Alerts – Email, SMS, and in-app notifications for signals and trades. ✔ 24/7 Operation – Runs continuously without manual input.

⚙️ How It Works

Create Account: Quick onboarding with verification and broker pairing.

Fund Your Wallet: Minimum deposit varies by region (typically around $250).

Set Parameters: Define your risk tolerance, assets of interest, and trading style.

Activate Bot: Begin trading in demo or live mode.

Monitor Results: Use analytics dashboard to track ROI, trade logs, and asset movement.

✅ Pros and ❌ Cons

✅ Pros:

Advanced AI for decision-making

Supports multiple assets (crypto, forex, stocks)

Easy to set up with guided onboarding

Great for passive and active traders alike

Responsive customer support

❌ Cons:

Limited educational resources for total beginners

High-performance tools gated behind premium plans

Not available in some regions due to broker limitations

👉 Open Your Fortune Maker Engine Account Now

👤 Real User Feedback

🗣 “I've seen a 35% ROI in just under two months using conservative settings. Impressive.” – Amelia T.

🗣 “Solid UI and customizable options. Perfect for intermediate traders.” – Rashid B.

🗣 “Wish there were more video tutorials, but the tech itself is great.” – Fiona M.

🔐 Is Fortune Maker Engine Legit or a Scam?

Based on internal testing, real user testimonials, and compliance with regulated brokers, Fortune Maker Engine is a legitimate tool in the AI trading space. Here's why:

Encrypted data security protocols

Verified partnerships with licensed brokerages

No reports of payment fraud or unfulfilled withdrawals

Responsive human customer support

Verdict: ✅ Legit – With consistent performance and transparency, it's worth exploring.

❓ Frequently Asked Questions (FAQs)

1. What is Fortune Maker Engine?

It’s an AI-powered auto-trading platform that analyzes markets and executes trades on your behalf.

2. Can beginners use it?

Yes. While having some financial knowledge helps, the platform offers a demo mode and guided setup.

3. Is my money safe?

Funds are held with regulated brokers and the platform uses encryption to protect user data.

4. What assets can I trade?

You can trade cryptocurrencies, forex, stocks, and more depending on your broker’s offerings.

5. How much does it cost?

A basic account is often free after your first deposit, but advanced features may require a premium subscription.

6. Does it guarantee profits?

No. All trading involves risk. The platform optimizes probability but cannot guarantee success.

7. Can I withdraw my funds anytime?

Yes. Withdrawals are processed within 24–72 hours depending on the method and broker.

👉 Open Your Fortune Maker Engine Account Now

🏁 Final Verdict

Fortune Maker Engine is a powerful AI-driven platform for automated trading and investment analysis in 2025. It’s ideal for users looking to take the guesswork out of trading, offering a mix of automation, custom settings, and smart analytics. While not entirely beginner-proof, it’s a solid tool with room for growth.

👉 Explore Fortune Maker Engine now and take your trading to the next level!

0 notes

Text

How Forex Spread Works: Understanding Bid-Ask Differences

In the vast realm of the foreign exchange market, the term Forex Spread plays a critical role in every transaction. At its core, Forex Spread refers to the difference between the bid and ask prices of a currency pair. This difference may appear small at first glance, yet it is pivotal in determining trading costs and overall market liquidity. Over time, seasoned market participants have come to view the spread as both a challenge and an opportunity—a fine line where market efficiency meets risk management.

During a recent conversation with a seasoned market analyst, Jordan, he remarked, “The dynamics of the Forex Spread are not just numbers on a screen; they represent the heartbeat of the market.” His statement encapsulates the sentiment felt by many professionals who see each spread movement as a signal of underlying market forces. The significance of Forex Spread is multifaceted: it affects trading decisions, risk management strategies, and ultimately, profitability.

This article aims to provide a deep dive into the mechanics of Forex Spread by exploring its components, underlying influences, and the strategies employed by market professionals. We will engage in a dialogue that not only explains the theory behind bid-ask differences but also offers practical insights drawn from real-world market scenarios. Our discussion is designed to be engaging and interactive, weaving together expert insights with relatable personal narratives. As you progress, you will encounter direct exchanges between market professionals, data-rich tables, and actionable tips that bring the abstract concept of Forex Spread into sharper focus.

The following sections have been crafted with a focus on clarity, expertise, and trustworthiness—ensuring that the information is both authoritative and accessible. Whether you are a novice eager to learn the basics or a seasoned professional looking to refine your strategy, this article is designed to resonate with your experiences. We will also incorporate various structures—from bullet points and numbered lists to tables and highlighted tips—to enhance readability and provide a multi-faceted understanding of the subject matter.

Let us embark on this journey into the intricacies of the Forex Spread, where every pip tells a story and each market shift can signal a new opportunity. The information provided here is grounded in industry experience, bolstered by data science insights, and enriched with direct dialogue from market experts. Prepare to engage with content that is as informative as it is captivating.

Table of Contents

Understanding Forex Spread Fundamentals

Components of Forex Spread: Bid vs Ask

Forex Spread Influencers: Liquidity and Volatility

Economic Indicators and Their Impact on Forex Spread

Technological Advances and Forex Spread Dynamics

Real-world Application and Risk Management in Forex Spread

The Future of Forex Spread and Market Innovations

1. Understanding Forex Spread Fundamentals

The concept of Forex Spread lies at the very foundation of foreign exchange trading. At its simplest, the spread is the cost incurred by a market participant when buying or selling a currency pair. This section delves into the essential elements that constitute the spread and examines why understanding this phenomenon is paramount for successful trading.

The Core Definition and Its Implications

The Forex Spread is defined as the numerical difference between the bid price (the price at which a market participant is willing to buy) and the ask price (the price at which they are willing to sell). For example, if the EUR/USD pair has a bid price of 1.1000 and an ask price of 1.1003, the spread is 0.0003 or 3 pips. Though the number might seem minimal, each pip can significantly impact a trader's profitability—especially in high-frequency trading environments.

Consider a conversation between two experienced professionals, Alex and Morgan, at a recent industry seminar:

Alex: "When I see a spread widen unexpectedly, it’s often a sign of underlying market hesitation." Morgan: "Exactly. It’s the market’s way of communicating risk. Every shift in the spread signals changes in liquidity and volatility that we must monitor closely."

This dialogue underlines the practical importance of the spread. It is not just a static cost but a dynamic indicator that reflects market sentiment and risk.

Historical Evolution and Market Perception

Historically, Forex spreads have evolved in tandem with market innovations. With the advent of electronic trading platforms, spreads have generally become narrower due to increased competition and improved market transparency. However, during periods of economic uncertainty or when significant news events occur, spreads can widen abruptly as liquidity providers adjust their risk models.

Many market participants recall the financial turbulence during the early 2000s when sudden spikes in spread values were commonplace. Such episodes highlighted the dual role of the spread as both a cost and a risk signal. In this context, a wider spread often meant that market participants were more cautious, waiting for further clarity before committing to trades.

The Multifaceted Nature of the Forex Spread

Several factors influence the Forex Spread, making it a multifaceted concept:

Market Liquidity: In highly liquid markets, the difference between the bid and ask tends to be minimal. Conversely, in less liquid situations, the spread can widen considerably.

Economic and Political Events: Geopolitical tensions, central bank announcements, and economic data releases can all affect market sentiment, leading to sudden changes in spreads.

Trading Volume: During periods of high trading volume, the competition among liquidity providers often results in tighter spreads. When volume declines, the opposite may occur.

Technical Factors: Modern trading algorithms and high-frequency trading systems can both narrow and widen spreads in milliseconds, reacting to shifts in market conditions almost instantaneously.

Practical Considerations for Traders

For those actively engaged in the market, understanding the nuances of the Forex Spread is crucial. Traders must evaluate the spread as part of their overall strategy, factoring it into calculations for trade entry and exit points, risk management, and profitability assessments. Here are a few practical tips:

Monitor Spread Trends: Regularly track the spread for your currency pairs to identify patterns. This can be particularly useful during key market events.

Compare Across Brokers: Different platforms may offer varying spreads. Choose a broker that aligns with your trading strategy and provides competitive pricing.

Integrate Spread Analysis with Technical Tools: Combine spread analysis with technical indicators like moving averages or Bollinger Bands to gain deeper insights into market conditions.

A Personal Reflection

Reflecting on my own early days in Forex trading, I remember sitting with my mentor at a local café, poring over market charts and spread movements. He once said, “Understanding the spread is like reading the pulse of the market.” That advice has guided my approach ever since, instilling in me a respect for the intricate balance between cost and risk.

The fundamental takeaways from this discussion are clear: the Forex Spread is not merely a byproduct of market mechanics but a vital signal of market behavior. By understanding its underlying principles, traders can better navigate the complexities of the foreign exchange market, making informed decisions that reflect both analytical precision and market intuition.

2. Components of Forex Spread: Bid vs Ask

At the heart of every Forex transaction lies the interplay between the bid and ask prices. This chapter breaks down the components that form the Forex Spread, offering a closer look at each element and its significance.

Defining the Bid and Ask Prices

Bid Price: The bid is the highest price that buyers are willing to pay for a currency pair. It represents the demand side of the market.

Ask Price: The ask, on the other hand, is the lowest price at which sellers are ready to part with a currency pair. It reflects the supply side.

When these two figures are juxtaposed, the resulting difference is the spread—a critical metric that directly influences trading costs.

The Dynamic Nature of Bid and Ask

Bid and ask prices are not static. They fluctuate based on market conditions, order flow, and even external economic news. One market participant, Sarah, noted in a recent interview, “I see the bid-ask gap as a live barometer of market sentiment. When the gap widens, it usually signals heightened uncertainty.” This observation is not uncommon among professionals who use real-time data to assess risk and liquidity.

Interrelationship and Market Impact

The relationship between the bid and ask is interdependent. A narrower spread indicates a more competitive market with high liquidity, while a wider spread may suggest low liquidity or increased volatility. For example, during high trading sessions, such as when major economic data is released, liquidity increases and spreads typically narrow. Conversely, during off-peak hours, reduced trading activity can lead to wider spreads.

Key Considerations in Spread Calculation

Order Execution: The speed and efficiency of order execution can influence the spread. Fast, automated systems tend to narrow the gap, while manual execution may lead to delays and a slightly wider spread.

Market Makers’ Role: Market makers provide liquidity by continuously quoting bid and ask prices. Their pricing models are based on a mix of algorithms and market conditions, ensuring that the spread remains competitive while managing risk.

A Closer Look Through a Data Lens

To further illustrate the bid-ask components, consider the following table, which compares key data points across several major currency pairs:

This table offers a snapshot of how different currency pairs can exhibit varying spread characteristics based on market conditions and liquidity. It is important to note that these figures are influenced by numerous factors, including market sentiment, global economic events, and the overall trading volume.

Engaging With the Data

In discussions with fellow market enthusiasts, the bid-ask dynamic often comes up as a critical component of daily trading strategies. One participant, known for his meticulous analysis, remarked, “Tracking bid and ask movements throughout the day gives me an edge—it’s like having a backstage pass to the market’s inner workings.” Such insights reinforce the practical importance of understanding both sides of the spread equation.

By delving into the components of the Forex Spread, traders gain not only a clearer understanding of cost structures but also a tool to gauge market sentiment. Whether you are fine-tuning an algorithm or making split-second decisions in a fast-moving market, the bid-ask relationship remains an indispensable metric.

3. Forex Spread Influencers: Liquidity and Volatility

Market conditions are rarely static, and two of the most significant influencers of the Forex Spread are liquidity and volatility. In this section, we explore how these factors interact to shape the cost of trading and what this means for market participants.

Liquidity: The Lifeblood of the Market

Liquidity refers to the ease with which an asset can be bought or sold in the market without significantly affecting its price. In a highly liquid market, such as major currency pairs during peak trading hours, the Forex Spread tends to be narrow. This is because numerous buyers and sellers contribute to a competitive pricing environment. When liquidity is abundant, market makers can quote tighter spreads since there is less risk of drastic price changes.

Consider this exchange from a seasoned analyst, Dana:

Dana: "High liquidity is like oil in a finely tuned engine—it keeps everything running smoothly, ensuring that spreads remain tight and trading costs low." Colleague: "That’s true. On the flip side, a drop in liquidity can suddenly widen the spread, catching even the most experienced traders off guard."

Volatility: The Measure of Uncertainty

Volatility, defined as the degree of variation in a currency pair’s price over time, is another key factor influencing the Forex Spread. When volatility is high, market participants become more cautious, and liquidity providers widen the spread to compensate for the increased risk. Volatility can be driven by geopolitical events, economic data releases, or unexpected market news.

In periods of market turbulence, such as during major elections or central bank policy shifts, spreads may widen dramatically. This widening is a risk management tool used by liquidity providers to mitigate potential losses from rapid price fluctuations. Volatility indicators, such as the Average True Range (ATR), are commonly used by traders to gauge this risk and adjust their strategies accordingly.

The Interplay Between Liquidity and Volatility

The relationship between liquidity and volatility is intricate. In a market where liquidity is low, even moderate volatility can lead to disproportionately wide spreads. Conversely, in markets characterized by high liquidity, even significant volatility might result in only a modest increase in the spread. This delicate balance underscores the importance of continuously monitoring both factors as part of a comprehensive trading strategy.

Key Points to Consider:

Market Sessions: During overlapping trading sessions (for example, the European and North American sessions), liquidity increases, leading to narrower spreads.

Economic News Releases: Sudden bursts of volatility around economic announcements can temporarily disrupt liquidity, resulting in wider spreads.

Algorithmic Trading: Advanced trading algorithms adjust their spread quotations in real-time based on evolving liquidity and volatility, adding another layer of complexity to market dynamics.

Practical Implications for Traders

Understanding how liquidity and volatility influence the Forex Spread is crucial for effective risk management. Traders can employ several strategies to mitigate the risks associated with wide spreads:

Time Your Trades: Avoid entering positions during low-liquidity periods or immediately before major economic announcements.

Utilize Technical Indicators: Use volatility indicators in conjunction with liquidity metrics to determine the optimal times for trade execution.

Adjust Position Sizing: When spreads widen due to high volatility, consider adjusting your trade size to manage risk more effectively.

A Data-Driven Perspective

Below is a concise table that illustrates hypothetical data on liquidity and volatility across various market sessions for a select group of currency pairs:

This table provides a snapshot of how liquidity and volatility might vary across different sessions and currency pairs. By examining such data, traders can tailor their strategies to optimize trade entries and exits based on real-time market conditions.

Reflecting on Market Experience

Reflecting on past market experiences, many seasoned traders recount times when a sudden drop in liquidity or a spike in volatility led to unexpected losses—or, in some cases, lucrative opportunities. One veteran commented during an industry roundtable, “The true test of a trader’s acumen lies in navigating the twin challenges of liquidity and volatility. They are the two sides of the same coin in Forex Spread management.”

By thoroughly understanding these influencers, market participants can better anticipate changes in the spread, adjusting their strategies proactively. This awareness, coupled with robust data analysis, empowers traders to mitigate risks and capitalize on fleeting market opportunities.

4. Economic Indicators and Their Impact on Forex Spread

Economic indicators are among the most influential factors in the foreign exchange market, affecting not only the value of currencies but also the dynamics of the Forex Spread. In this section, we examine how economic data—ranging from employment reports to central bank announcements—shapes market behavior and influences the bid-ask differential.

The Role of Economic Data

Economic indicators such as GDP growth, unemployment rates, inflation figures, and manufacturing indices provide insights into the overall health of an economy. When these indicators point to robust economic performance, confidence in a currency tends to increase, thereby attracting more trading activity. This increased activity usually results in tighter Forex Spreads due to improved liquidity.

Conversely, disappointing economic data can lead to uncertainty and risk aversion. In such cases, liquidity providers may widen the spread to shield themselves against potential losses. For example, a sudden downturn in a country’s manufacturing sector might prompt market participants to demand higher premiums for the risk associated with trading that currency pair.

Central Bank Policies and Their Influence

Central banks play a pivotal role in influencing the Forex Spread through monetary policies. Interest rate decisions, quantitative easing programs, and forward guidance are all factors that can affect both currency valuation and market liquidity. Consider the following dialogue between two financial experts during a recent webinar:

Lydia: "When the central bank signals a potential interest rate cut, the ensuing uncertainty usually leads to wider spreads as market makers brace for volatility." Marcus: "Indeed. The anticipation of policy shifts often translates into cautious pricing, which we see reflected in the bid-ask differences."

This exchange illustrates how central bank communications can trigger market responses, leading to adjustments in the Forex Spread. Traders often monitor central bank announcements closely, as even a slight change in tone can alter market dynamics significantly.

Global Economic Events and Their Ripple Effects

Beyond individual economic reports, global events such as trade disputes, geopolitical tensions, and natural disasters also play a role in shaping Forex Spreads. Such events can disrupt normal trading patterns and create a ripple effect that extends across multiple currency pairs. The interconnectedness of global markets means that a crisis in one region can lead to wider spreads in seemingly unrelated markets.

Economic Impact Breakdown:

Inflation Data: Higher-than-expected inflation can prompt central banks to tighten monetary policy, which may reduce liquidity and widen spreads.

Employment Figures: Strong employment numbers typically boost market confidence, leading to tighter spreads due to increased trading activity.

Consumer Spending: Robust consumer spending signals economic health, attracting liquidity and thus narrowing the Forex Spread.

A Comprehensive Look at the Data

The interplay between economic indicators and Forex Spread is best understood through data. The table below summarizes hypothetical data points that illustrate this relationship:

This table serves as a reference for understanding how various economic indicators might influence liquidity and, consequently, the Forex Spread. It is important for traders to integrate such data into their decision-making processes, ensuring that their strategies reflect real-time economic realities.

Integrating Economic Insights into Trading Strategies

For market professionals, the ability to interpret economic indicators in the context of Forex Spread is invaluable. Here are some practical approaches:

Monitor Economic Calendars: Keep track of upcoming economic releases and central bank meetings to anticipate changes in market conditions.

Use Technical Analysis in Tandem: Combine economic data with technical analysis tools to gauge the likely impact on spreads.

Adopt a Flexible Approach: Adjust your trading strategy based on real-time economic news. In periods of high uncertainty, consider reducing trade sizes or widening stop-loss levels to manage risk.

A Personal Narrative on Economic Data

During a particularly volatile period last year, I recall a conversation with a fellow analyst, Rebecca, who emphasized the importance of reading economic signals. “When I see the unemployment rate drop unexpectedly, I know it’s time to pay closer attention to my spread metrics,” she explained. This personal insight resonated with me, highlighting the critical link between economic performance and trading costs.

Economic indicators not only shape market expectations but also serve as a barometer for risk management in Forex Spread. By staying attuned to these signals, traders can better navigate the complexities of the market, ensuring that they remain agile in the face of rapid changes.

5. Technological Advances and Forex Spread Dynamics

The evolution of technology has revolutionized every aspect of the foreign exchange market, including the dynamics of the Forex Spread. In this section, we explore how innovations in trading platforms, algorithmic systems, and data analytics have transformed spread management, making markets more accessible and efficient.

The Digital Transformation of Trading

Over the past two decades, the digitalization of trading systems has brought about a paradigm shift in how Forex Spread is determined and managed. Automated trading platforms and high-speed data feeds allow liquidity providers to adjust bid and ask prices in real-time. This digital transformation has contributed to narrower spreads during periods of high market activity, as computational efficiency ensures that pricing remains competitive.

Algorithmic Trading and Real-Time Adjustments

Algorithmic trading systems play a crucial role in managing Forex Spread. These systems analyze vast amounts of market data within milliseconds, identifying opportunities and adjusting spreads to balance supply and demand. During a panel discussion at a recent fintech conference, one expert stated, “The speed at which algorithms can process information and recalibrate the spread is nothing short of remarkable. It’s a game changer for risk management.” Such advancements have not only improved market efficiency but have also increased transparency for retail and institutional traders alike.

Data Analytics and Predictive Modeling

Advancements in data analytics have further enhanced the ability to forecast changes in the Forex Spread. Predictive models, which leverage historical data and machine learning techniques, help traders anticipate periods of high volatility or low liquidity. These models incorporate a myriad of variables—from trading volume and economic indicators to geopolitical events—to provide a comprehensive outlook on market conditions.

Key Technological Features:

High-Speed Data Feeds: Enable real-time tracking of bid and ask fluctuations.

Automated Execution: Minimizes human error and ensures rapid trade execution.

Predictive Analytics: Helps forecast potential spread fluctuations based on historical trends.

A Glimpse into the Future

Reflecting on the current state of technological innovation, it is clear that the impact on Forex Spread dynamics will only intensify. Future advancements are likely to include even more sophisticated AI-driven models, enhanced data visualization tools, and further integration of blockchain technology to ensure greater transparency and security in trade execution.

Dialogues and Anecdotes

During a candid conversation with a respected colleague, Liam, he remarked, “Every time I see a breakthrough in algorithmic trading, I feel the pulse of innovation shifting the market landscape. The way technology continuously reshapes the Forex Spread is both inspiring and challenging.” Such remarks underscore the importance of staying updated on technological trends to maintain a competitive edge.

Practical Implications for Market Participants

For traders and investors, embracing technological advancements is essential. Consider the following actionable tips:

Stay Informed: Regularly review updates on trading technology and platform enhancements.

Invest in Training: Develop proficiency in using algorithmic tools and data analytics software.

Collaborate with Tech Experts: Work closely with technology professionals to optimize trading strategies in response to changing market conditions.

Technological progress has democratized access to sophisticated trading tools, enabling a wider range of participants to engage in the Forex market. By leveraging these tools, traders can achieve a more nuanced understanding of the Forex Spread and execute trades with greater precision.

6. Real-world Application and Risk Management in Forex Spread

While theoretical knowledge is essential, the true test of understanding Forex Spread comes in real-world application. This section delves into practical strategies for managing risk, optimizing trade execution, and ensuring that the spread remains a manageable cost rather than an unforeseen liability.

Practical Strategies for Spread Management

Successful market participants combine a robust understanding of Forex Spread with concrete risk management techniques. Here are some strategies that have proven effective in live trading scenarios:

Adaptive Order Types: Utilize limit orders and stop-loss orders to control entry and exit points, reducing the impact of sudden spread fluctuations.

Dynamic Position Sizing: Adjust trade sizes based on current spread conditions to minimize exposure during periods of high volatility.

Regular Spread Analysis: Incorporate routine analysis of spread trends into your daily trading routine. This can help identify when market conditions are favorable or when caution is warranted.

Risk Management Techniques

Risk management in Forex trading is as much an art as it is a science. The following techniques are widely adopted to ensure that the Forex Spread does not erode trading capital:

Hedging Strategies: Implementing hedging techniques can help offset potential losses when spreads widen unexpectedly.

Diversification: Spreading trades across multiple currency pairs can reduce the impact of adverse movements in any single market.

Technical and Fundamental Analysis Integration: Combine chart analysis with economic insights to gauge the likely behavior of spreads during volatile periods.

Engaging Dialogue on Real-World Experience

During an informal discussion at a recent workshop, a veteran market practitioner, Elena, shared her insights:

Elena: "I remember a day when the spread on a major pair suddenly doubled during a key economic announcement. It was a wake-up call—one that reinforced the need for robust risk controls." Peer: "That’s when I realized the importance of not just relying on automated systems, but also keeping a close eye on market news and adjusting strategies on the fly."

Such exchanges highlight that managing Forex Spread is not just about numbers—it’s about understanding market behavior, staying agile, and being prepared for the unexpected.

Tools and Techniques for Monitoring Spreads

In today’s digital age, a variety of tools are available to help traders monitor the Forex Spread in real time:

Charting Software: Advanced charting platforms allow for the visualization of spread movements alongside price action.

Economic Calendars: Real-time economic calendars provide alerts on upcoming events that could impact spread dynamics.

Risk Management Platforms: Dedicated software solutions help traders model different scenarios and adjust their risk profiles accordingly.

A Real-World Case Study

Consider the case of a mid-sized investment firm that specializes in foreign exchange trading. During a period of political uncertainty in a major economy, the firm observed a significant widening of the Forex Spread. The risk management team swiftly recalibrated their strategy, reducing position sizes and diversifying their currency exposure. Within days, as market conditions stabilized, they gradually increased their exposure again. This case underscores the importance of a flexible, responsive approach to spread management.

Practical Tips for Traders

Monitor Real-Time Data: Always keep an eye on the live spread, especially during periods of economic or political turbulence.

Stay Connected: Engage with the trading community through forums and discussion groups. Shared experiences can provide invaluable insights.

Review and Adjust: Regularly review your risk management strategy and make necessary adjustments based on evolving market conditions.

By integrating these practices, traders can ensure that the Forex Spread remains a controlled and manageable element of their overall trading strategy, rather than a hidden cost that erodes potential profits.

7. The Future of Forex Spread and Market Innovations

Looking forward, the landscape of Forex Spread is poised for continued evolution. In this final detailed chapter, we explore the future trends and innovations that are likely to shape the bid-ask dynamics and the broader foreign exchange market.

Emerging Trends and Innovations

Several trends point toward a future where Forex Spread dynamics will become even more refined:

Artificial Intelligence and Machine Learning: These technologies will drive more predictive models for spread behavior, enabling traders to anticipate market movements with greater accuracy.

Blockchain and Distributed Ledger Technology: Enhanced transparency and security in trade execution are expected to reduce counterparty risks and potentially narrow spreads.

Integration of Big Data Analytics: Real-time processing of vast datasets will offer deeper insights into market conditions, allowing liquidity providers to adjust spreads more dynamically.

Anticipated Market Shifts

The evolution of market structure will likely lead to a more democratized trading environment. As technology further reduces transaction costs, even retail traders may experience tighter spreads similar to those enjoyed by institutional players. This shift could result in a more competitive marketplace, with benefits including:

Lower Transaction Costs: Tighter spreads will directly translate into lower costs for traders, enhancing overall market efficiency.

Increased Market Participation: As barriers to entry are reduced, a broader range of participants will contribute to market liquidity.

Enhanced Risk Management: Improved forecasting and real-time analysis will enable more sophisticated risk management strategies.

A Visionary Dialogue

During a roundtable discussion on market innovation, a prominent economist, Dr. Stevens, remarked:

Dr. Stevens: "The future of Forex Spread is intertwined with technology. As we refine our analytical tools, the spread will become not just a cost factor but a dynamic indicator of market health." Moderator: "So, do you see a future where spreads could be almost negligible?" Dr. Stevens: "Potentially, yes. But with lower spreads comes the need for heightened vigilance. The market will always reward those who remain adaptive and informed."

Strategic Considerations for the Future

Traders should begin to incorporate emerging technologies and data analytics into their strategic planning:

Invest in Technology: Allocating resources to upgrade trading platforms and analytical tools can pay dividends in a rapidly evolving market.

Continuous Learning: As market innovations emerge, ongoing education and adaptation will be essential. Engage with industry experts, attend seminars, and read the latest research to stay ahead.

Scenario Planning: Develop strategies that account for both the promise of lower spreads and the inherent risks of a more dynamic trading environment.

Final Thoughts on Market Innovations

The future of Forex Spread promises a blend of opportunity and challenge. While technology is expected to streamline trading costs and improve market transparency, it also demands that traders remain agile, informed, and ready to adjust their strategies. The path ahead is one of continual evolution, where each advancement in data science and trading technology opens new avenues for both profit and risk management.

Conclusion

In closing, our exploration of Forex Spread has taken us through its fundamental concepts, the intricate dance between bid and ask prices, and the influential factors of liquidity, volatility, and economic indicators. We delved into how technological innovations have reshaped spread dynamics, and examined practical strategies for managing risks in live market scenarios. The dialogues and personal narratives interwoven throughout this article have underscored the human element behind every trade—illustrating that Forex Spread is more than just a numeric difference; it is a dynamic reflection of market sentiment and an essential tool in the trader’s arsenal.

As we look to the future, the interplay between technology and market behavior promises to refine the mechanics of Forex Spread even further. For traders, embracing these changes while maintaining a strong focus on risk management will be key to navigating an increasingly competitive environment. This article is a testament to the depth and complexity of the foreign exchange market—a realm where every pip tells a story and every spread serves as a guidepost for opportunity and risk.

Actionable Insights

Stay Informed: Regularly review market news and economic calendars.

Invest in Technology: Upgrade your trading tools to take advantage of real-time data and predictive analytics.

Engage in Continuous Learning: Participate in industry forums, seminars, and professional discussions.

Adapt Strategies: Be ready to adjust trade sizes and risk controls in response to changing spread conditions.

The Forex market continues to evolve, and with it, the strategies for managing Forex Spread will undoubtedly adapt. By maintaining a focus on analytical rigor and technological integration, traders can turn the intricacies of bid-ask differences into a strategic advantage.

Bibliography

Financial Times, “How Market Liquidity Affects Forex Spreads,” Financial Times Analysis Reports, 2023.

Bloomberg, “Central Bank Policies and the Impact on Forex Trading Costs,” Bloomberg Markets, 2022.

Reuters, “Technological Innovations in Forex Trading: A New Era,” Reuters Special Reports, 2023.

Investopedia, “Understanding Bid-Ask Spreads in Forex Trading,” Investopedia Education, 2021.

0 notes

Text

what is the best indicator for trend reversal

🔁 What Makes a Good Reversal Indicator in Forex Trading?

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

Introduction

In forex trading, timing the beginning or end of a trend can be a game-changer. While trend-following strategies help traders ride the momentum, identifying a trend reversal allows them to enter early and capture larger price moves. However, spotting reversals is far more challenging than following trends. This is where reversal indicators come into play.

But not all indicators are created equal. Many promise precision but deliver false signals. So what actually makes a good reversal indicator? In this detailed article, we'll explore the critical qualities that define reliable reversal indicators, how they work, and which ones meet these standards. Whether you're a beginner or an experienced trader, understanding these principles will improve your ability to spot and trade reversals confidently.

Why Reversal Indicators Matter

Reversal indicators are technical tools designed to alert traders when the current trend is losing momentum and possibly preparing to change direction. The earlier you can detect a potential reversal, the better your entry point and risk-to-reward ratio.

For example:

In a downtrend, entering long (buy) at the reversal point allows traders to profit as the market turns upward.

In an uptrend, identifying when momentum is fading can help traders short at the top, catching the move down.

Accurate reversal detection is especially critical for:

Swing traders: who aim to catch medium-term movements.

Scalpers: who require pinpoint entries on lower timeframes.

Position traders: who want to avoid entering at the end of a trend.

However, not all reversal signals are worth acting on. That’s why it’s important to understand what makes a reversal indicator trustworthy.

Core Features of a Good Reversal Indicator

Here are the key characteristics that define a reliable reversal indicator in forex trading:

1. Timely Signal Generation

A good reversal indicator provides early signals before or near the beginning of the reversal — not after the price has already moved significantly.

Too early = false signal

Too late = missed opportunity

It must strike the right balance. It should not just lag behind the price but rather react to weakening momentum, divergence, or changes in price structure.

2. High Signal Accuracy

Accuracy is crucial. A good indicator must:

Minimize false signals

Confirm only high-probability setups

This doesn't mean it has a 100% success rate, but the win-to-loss ratio should be favorable when used properly. It should provide clear, unambiguous signals—not constant alerts that leave traders confused.

3. Clarity and Simplicity

An effective reversal indicator is easy to interpret, especially under real-market pressure. Indicators that rely on overly complex calculations or hard-to-read visuals can lead to poor decisions.

Example:

An RSI indicator showing divergence at oversold levels is straightforward.

An exotic oscillator with dozens of settings might confuse traders unless fully mastered.

4. Compatibility with Price Action

Reversal indicators work best when they align with price action principles like:

Support/resistance zones

Candlestick patterns

Trendlines or chart structures

A reversal signal becomes far more reliable when the indicator and price behavior agree.

5. Multi-Timeframe Usefulness

A good reversal tool should function well across different timeframes:

On H4/D1 for swing traders

On M15/M5 for scalpers

It should also align on higher timeframes for better confirmation (e.g., if an indicator shows reversal on H4 and H1, the signal is stronger).

6. Works with Trend & Counter-Trend Trades

While reversal indicators are primarily used to catch tops and bottoms, the best ones can also be used:

For pullback entries during trends (minor reversals)

To confirm trend continuations after fake-outs

This flexibility is a sign of a mature and tested tool.

7. Backtest Proven

The best indicators are not based on hype but data. A good reversal indicator should:

Be backtested on different pairs and conditions

Show consistent performance

Work during ranging and trending markets

Indicators with solid historical performance are more likely to succeed in live environments.

Technical Foundations of Reversal Detection

A reliable reversal indicator often works based on one or more of the following principles:

🔁 1. Momentum Shifts

Indicators like RSI, MACD, and Stochastic Oscillator detect when momentum is fading, often before price turns.

Bearish divergence (price makes higher highs, RSI makes lower highs) indicates weakening bullish momentum.

Bullish divergence (price makes lower lows, RSI makes higher lows) suggests a bullish reversal.

📉 2. Overbought/Oversold Conditions

Oscillators that measure how "stretched" a price is — like RSI and Stochastic — help traders spot points where price is likely to snap back.

Example:

RSI > 70 = overbought → potential sell

RSI < 30 = oversold → potential buy

🧱 3. Break of Market Structure

Indicators that detect support/resistance breakouts or trendline breaks can highlight early reversals. Tools like Fractals, ZigZag, or price structure break alerts are useful here.

📈 4. Volume Confirmation

Volume indicators like On-Balance Volume (OBV) or Volume Spike detectors show whether large traders are entering or exiting positions, signaling potential reversals.

Examples of Good Reversal Indicators

Let’s look at some indicators that meet most of the criteria above:

✅ 1. Relative Strength Index (RSI)

Tracks momentum and overbought/oversold zones.

Works well with divergence for reversal spotting.

Best when combined with price action or support/resistance levels.

✅ 2. MACD (Moving Average Convergence Divergence)

Shows momentum shifts and crossovers.

Divergence between MACD and price is a strong reversal signal.

Smooths out price noise but may lag slightly.

✅ 3. Stochastic Oscillator